Original|Odaily Planet Daily(@OdailyChina)

Author|Wenser(@wenser 2010)

Last weekend, besides the "Bithumb airdrops 620,000 BTC" misinformation incident, another breaking news story sparked widespread discussion: the mysterious buyer behind the premium domain ai.com has finally been revealed. Contrary to many expectations, the buyer was not from an AI giant but Kris Marszalek, co-founder and CEO of the cryptocurrency exchange Crypto.com.

This transaction, finalized in April 2025, amounted to a staggering $70 million, giving the outside world a direct glimpse into the astonishing financial power of crypto big shots. This deal not only ended the ownership battle surrounding the domain but also drew a conclusion to the previous "premium domain pointing war" among giants like OpenAI and xAI.

The Battle for ai.com: A Three-Year, Sky-High Transaction War

In November 2022, with the groundbreaking launch of ChatGPT (GPT 3.5), AI instantly became the prominent field of the era, and the prices of related domain names naturally soared.

In February 2023, rumors suggested that OpenAI, the parent company behind ChatGPT, had purchased ai.com. This was later confirmed as fake news, though the domain's listed selling price of $11 million in 2021 was still jaw-dropping.

In August 2023, the ai.com domain's pointing address was changed to xAI, the AI company under Musk's umbrella, which again attracted significant attention.

From then on, more information about this premium domain was uncovered: the domain was first registered in May 1993, making it over 30 years old, a veteran in the domain world. However, Musk remained indifferent to the matter, making the market realize once again that changing the domain's pointing address was merely a marketing tactic by the ai.com holder to "wait for the highest bidder."

It reappeared in the public eye recently with the news that it was "sold for a whopping $70 million."

Public information reveals that Crypto.com co-founder and CEO Kris Marszalek successfully acquired this premium domain, setting one of the highest publicly disclosed domain sale records to date; the transaction was facilitated by domain broker Larry Fischer and was paid for in cryptocurrency. For reference, this sky-high price is double the previous sale price of the premium domain voice.com.

As an established crypto exchange founded in 2016, Crypto.com has long been renowned in the industry for its "massive marketing moves," having previously engaged in market promotion through sports sponsorships and celebrity endorsements; in 2021, it even splurged $700 million just to secure the naming rights for a sports stadium in Los Angeles.

In an interview with the media, Kris Marszalek revealed that he had "received even more outrageous resale offers but chose to hold onto the domain" because he believes it will be crucial for the future business's trust and recognition. Moreover, he boldly declared: "We fought our way to the top among thousands of crypto exchanges back then, and this time we will make ai.com a success again."

Thus, the years-long battle over the ai.com premium domain came to an end; just as the market was anticipating and speculating on how Kris Marszalek would use this domain, he unexpectedly "pulled a big one."

The Botched "Product Launch": ai.com Went Down Within 48 Hours of Going Live

Crypto.com co-founder and CEO Kris Marszalek posted that after buying the domain, he had been building quietly and would launch the product during the Super Bowl on Sunday (February 8). He later stated that with the AI Agent on the ai.com platform, users would soon be able to deploy their own agents to perform a series of actions on their behalf, such as stock trading, automating workflows, using calendars to schedule and execute daily tasks, all while maintaining privacy, based on user permissions, and entirely under user control.

But amidst great anticipation, ai.com staged a "downtime drama" within less than 48 hours of its launch.

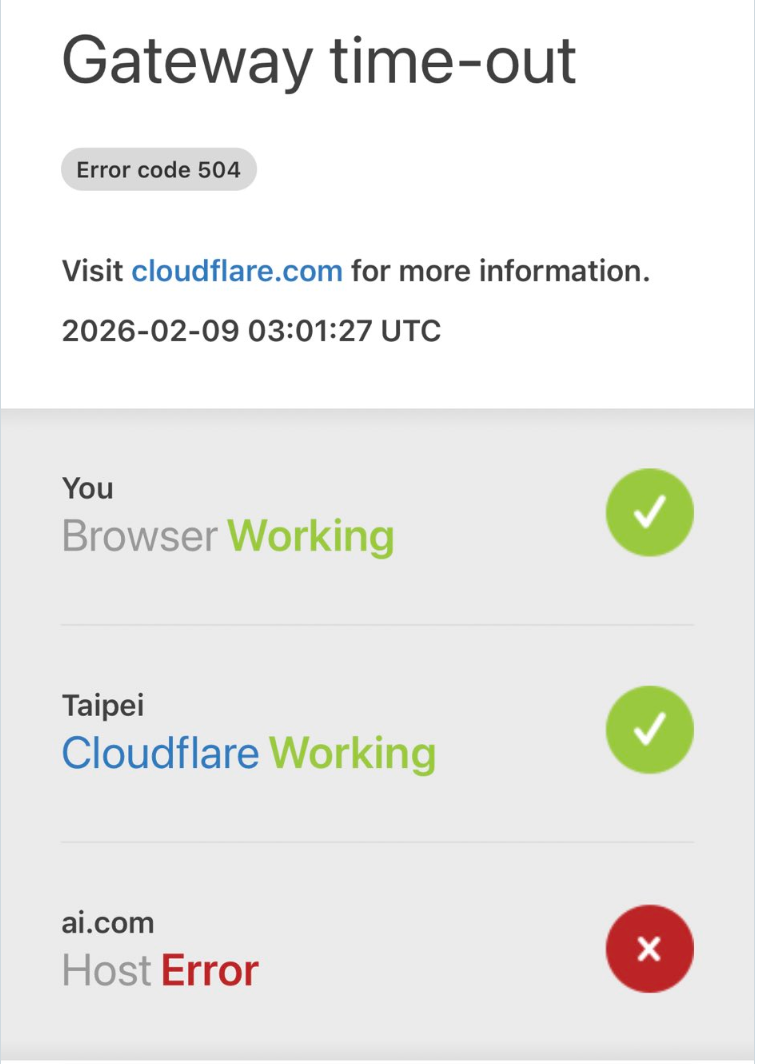

This morning, NVIDIA engineer yuhang posted, "This $70m domain, after $8m in ads(Odaily Planet Daily note: the general price of a Super Bowl ad), 504'd".

It has to be said, this incident once again confirms that saying—"The whole world is just a slightly larger amateur operation."

As of the time of writing, the ai.com website has returned to normal. Users can抢先 register personal subdomains and AI Agent subdomains to experience the platform's corresponding functions later; as for whether it can deliver on the "autonomous AI Agent" promised in Kris Marszalek's grand vision, the author will reserve judgment for now.

The "Mainstreaming Path" of Crypto Big Shots: Some Buy Houses, Some Buy Power Plants

Another hot topic brought up by the Crypto.com co-founder and CEO spending $70 million on a premium domain is the various paths to mainstreaming that crypto big shots choose for themselves.

Previously, there was Justin Sun spending millions on a lunch with Warren Buffett. Recently, the moves by crypto大佬 have become more diverse:

Aave founder Stani Kulechov bought a mansion worth £22 million (approximately $30 million) in London's Notting Hill last November.

Tether CEO Paolo focuses more on "putting eggs in different baskets." Reliable sources indicate that Tether has invested profits from its stablecoin business into 140 investments covering fields from agriculture to sports and plans to expand its workforce to 450 people; additionally, Tether's gold reserves exceed $23 billion.

Last November, Justin Sun, through his family office SunFund Energy, acquired two small hydropower plants in Norway at once, with a total installed capacity of 86 MW and an annual electricity generation of about 350 GWh, equivalent to the annual electricity consumption of 40,000 European households. In the era of the AI great navigation, the ever-bold Justin Sun chose to hold a "power ticket" to board this era's train.

Regardless of the investment outcomes, cryptocurrency is thereby becoming known to more people through its various forms in news—as a payment currency, a character symbol, an asset class, etc. Perhaps this is an indispensable part of cryptocurrency's journey into the mainstream.